If this was poker, Erewhon called then raised Whole Foods. Warm lights, inviting color palettes, a store size that is less intimidating than a big box retailer. Check. Only organic produce, bias towards pasture-raised and bias against seed oils. Raise.

Erewhon is an experience, where shoppers are encouraged to casually stroll the aisles, learn about oxygenated water and talk with their supplement expert on the latest magnesium. Erewhon is a place to see and be seen. You’ll pay for this quality and experience with Erewhon commanding the highest prices on the market. Opponent folds.

This is why I was flummoxed when Erewhon started offering nationwide shipping on nonperishables. In the age of buying groceries online, shopping in person is core to the Erewhon experience.

I was equally puzzled to learn about Erewhon’s membership. As outlined in my recent Thrive Market newsletter, membership-only retailers like Costco and Thrive use their high margin revenue stream (membership dues) to offer the lowest prices on goods and groceries.

Erewhon’s membership is instead optional, not required, and their prices remain $$$$.

Erewhon has redefined the retail strategy across memberships, private label, e-commerce, and competition. And for its ten stores in LA doing ~$250m in sales, it’s working.

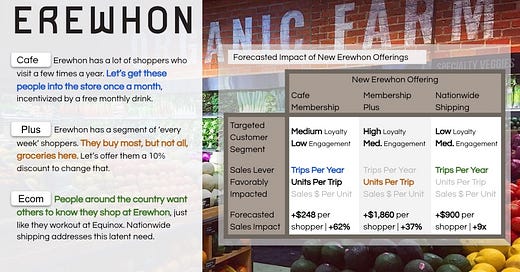

This edition of the Modern Acre Newsletter seeks to better understand Erewhon’s trailblazing path. We segment Erewhon’s shoppers on the axes of Loyalty (i.e., frequency they shop Erewhon) and Engagement (i.e., # of categories within the store they purchase from).

This shopper segmentation enabled me to map Erewhon’s new offerings – memberships and nationwide shipping – against shopper personas. As is par for the course, I then illustrate the financial impact of the offerings for the targeted shopper persona.

Shopper Segmentation

The below table segments Erewhon’s shoppers into nine personas based on how frequently they shop Erewhon and how many categories / aisles / sections of the store they buy from.

The nine personas in aggregate follow the MECE principle: mutually exclusive, collectively exhaustive (i.e., the nine personas together represent all of Erewhon’s shoppers).

The description of each persona is an illustration. For example, I say Persona [8] bypasses the farmers market to buy produce from Erewhon. This person buys hot meals, produce and dairy, but not shelf stable foods or supplements. They live close to an Erewhon and shop there frequently, once every one or two weeks. This person is indicative of Persona [8], but Persona [8] is not exclusive to this person.

We can now map Erewhon’s new offers against the nine personas:

The Cafe Membership targets Persona [4], shoppers with Medium Loyalty and Low Engagement.

The Membership Plus targets Persona [8], shoppers that frequently shop Erewhon across a few category types such as the cafe, produce, dairy, and meat.

Nationwide shipping targets Persona [2], people who do not live in LA, but want to be associated with the Erewhon brand.

Memberships

Erewhon offers two memberships – the Cafe, priced at $100 per year, and the Plus, priced at $200 per year.

Both the Cafe and Plus include a free tonic drink every month. If the free drink is valued at $8, Cafe members effectively break even on the $100 membership if all they do is redeem their free drink ($8 * 12 months).

Cafe members receive 10% off the cafe while Plus members receive 10% off cafe and most grocery items. The membership also gives less tangible perks like priority access to events.

For the first two perks – save 10% and free monthly drink – we can illustrate the financial impact of the memberships.

Cafe Membership

The Cafe Membership incentivizes a shopper to visit Erewhon at least monthly so they can collect their free drink. This membership is therefore targeting shoppers who shop Erewhon less than once a month and primarily shops Cafe versus Grocery. This is Persona [4].

Here’s where we make assumptions to illustrate the financial impact. Persona [4] shops Erewhon 8x per year, spends $25 at the Cafe, and since they’re already at Erewhon, does some light grocery shopping, spending another $25. The $25 they spend at the Cafe is across an $8 coffee and $17 in food.

The member now shops Erewhon 12x per year to receive the $8 drink for free. Equipped with the 10% Cafe discount, they purchase an additional $6 snack.

Prior to Cafe Membership:

8 (Trips Per Year) * ($8 + $17 (Cafe Spend Per Trip) + $25 (Grocery Spend Per Trip)) = $400 (Spend Per Year)

With Cafe Membership:

Cafe Spend = (

$8$0 + $17 + $6 (New Snack) * (1 - 10% (Cafe Discount))) = $20.70(12 (Trips Per Year) * ($20.70 (Cafe Spend Per Trip + $25 (Grocery Spend Per Trip))) + $100 (Cafe Membership Dues) = $648.40

The Cafe Membership drives an incremental $248.40 in revenue per Persona [4] shopper, a 62% increase.

Membership Plus

While the key sales lever that the Cafe Membership targets is Trips Per Year, the Membership Plus targets Sales $ Per Trip, specifically Units Per Trip.

I’ll actually make the assumption Plus doesn’t change Trips Per Year. This is a loyal Erewhon shopper, visiting the store every week. They buy their produce here and a couple other items that they can’t find elsewhere. They also go to one or two other retailers throughout the month. The Membership Plus is here to convince these shoppers to buy all their groceries at Erewhon. This is Persona [8].

Persona [8] shops Erewhon 50x per year(!!), spends $25 and $75 at the Cafe and on groceries, respectively.

Incentivized by the 10% grocery discount, this member now spends $125 on groceries. Other than the change in grocery spend, I keep the same assumptions from the Cafe membership illustration for this illustration.

Prior to Membership Plus:

50 (Trips Per Year) * ($8 + $17 (Cafe Spend Per Trip) + $75 (Grocery Spend Per Trip)) = $5,000 (Spend Per Year)

With Membership Plus:

Cafe Spend = $20.70

Grocery Spend = ($125 (Spend Per Trip) * (1 - 10% (Grocery Discount))) = $112.50

(50 (Trips Per Year) * ($20.70 + $112.50)) + $200 (Membership Plus Dues) = $6,860

The Membership Plus drives an incremental $1,860 in revenue per Persona [8] shopper, a 37% increase.

Nationwide Shipping

You used to live in LA and shop at Erewhon. Or, you are one of Erewhon’s 492,000 Instagram followers, but have never lived in LA.

Either way, you want to be associated with the Erewhon brand. Sure you could buy many of the same brands at Thrive Market or direct from the brand’s website, but people! It’s about Erewhon’s private label. Erewhon’s sea moss gummies, spring water, and tote bag. My hand is… raised. Sans the $52 tote bag.

Someone who doesn’t live in LA shops Erewhon very infrequently. We’ll say once per year. They splurge on that trip, spending $40 at the Cafe and $60 in groceries. Nationwide shipping won’t change how frequently they visit LA nor the in-person basket size. Nationwide shipping does change how frequently they purchase from Erewhon. This is Persona [2].

We’ll say they now spend $75 at Erewhon 1x per month, with $75 being the minimum order value required for free shipping. This results in an incremental $900 in sales for a total of $1,000, up from $100.

While an incremental $900 is meaningful, this segment also represents significantly fewer people than do the first two segments. As such, the total topline impact to Erewhon won’t be as large.

Conclusion

E-commerce is a must for retailers in today’s age. Membership-model, low-priced retailers remain popular and are growing in market share.

What makes Erewhon Erewhon is the in-store shopping experience and the highest priced groceries and hot bar, with quality to match.

Antithetical to Erewhon’s strategy is e-commerce and memberships. Or, so I thought. Segmenting shoppers by loyalty and engagements enabled us to view shoppers as nine different personas. That’s when Erewhon’s nationwide shipping and memberships began to make sense.

Erewhon has a lot of shoppers who visit a few times a year. Let’s get these people into the store once a month, incentivized by a free monthly drink.

Erewhon has a segment of ‘every week’ shoppers. They buy most, but not all, groceries here. Let’s offer them a 10% discount to change that.

And alongside organic and pasture-raised, Erewhon has built a brand that is more designer than grocery. People around the country want others to know they shop at Erewhon, just like they workout at Equinox. Nationwide shipping addresses this latent need.

Please let me know what you thought of this newsletter in the comments below!

For more Modern Acre Newsletters, visit our Substack homepage here.